Solo traveling can be a very rewarding experience, but women have many things to consider when gallivanting the world alone. Luckily there are apps in place to help navigate unfamiliar destinations, convert foreign currencies, keep you safe and more.

See our list of the best credit card bonuses here.

In this guide we’ll cover a few apps every female solo traveler should have on her phone.

Don’t know where to solo travel to? Check out our list of the best destinations for women traveling alone. If you want to read about other great places to visit, see this list of best travel destinations to use the points and miles you’ve earned with your credit card rewards and loyalty programs.

Navigation & Transportation

Citymapper is a navigation app that provides transit maps, line status, real-time departure timings on public transport and real-time disruption alerts. It covers most major cities in the United States, Europe, Asia and Australia.

You’ll want a rideshare app no matter where you are in the world, especially if it’s late at night. Do some research and see which app is safe and popular in your destination. In the United States and Europe, go with Lyft or Uber. Grab is popular in the Asian market. Those in Spain and Latin America often use Cabify. Bolt is well-loved in France, Australia and some African countries. And Careem is the go-to choice in Turkey and the Middle East.

All are available on iOS and Android.

Safety

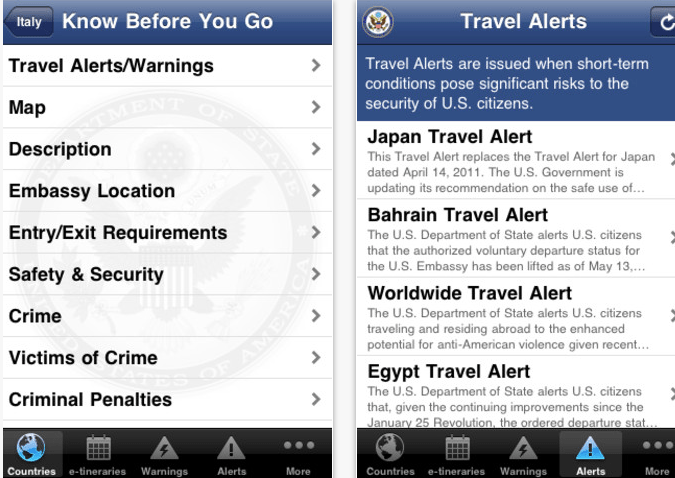

Smart Traveler is an app by the U.S. Department of State which offers tips and information for American travelers. It lists visa and vaccine information, as well as travel advisories. When you register your trip on the app, your information gets relayed to local embassies and consulates in your destination country. In the event of disaster or crisis, the local embassy will be able to contact you.

TripWhistle Global SOS connects you to local emergency police, fire and ambulance numbers anywhere in the world with the tap of a button. It provides your location to emergency responders while notifying your loved ones of your whereabouts.

Noonlight triggers a call to emergency services and sends help to your exact location when you hold and release the main button. If you activate the service by accident, you have 10 seconds to enter your PIN to cancel the alarm. Noonlight can connect to your Lyft, Uber and Tinder apps. Note: Only available in the United States.

Other

Tourlina safely and easily connects solo female travelers with other women. It works like a dating app, matching you with other women who have similar interests, destinations and traveling time. After entering your destination and travel dates, swipe left (no) or right (yes) on profiles. If you match, you can message each other and plan your trip together.

CalConvert is a calculator, currency and unit converter. It features basic calculator operations, mathematical functions, scientific functions, and over 600 units and 150+ currencies to convert.

Available on iOS.

You’ll have plenty of time to read when you’re traveling solo. That’s where Kindle comes into play. Access all of your purchased books and sync them to where you left off on other devices.

Finding the nearest public toilet is a breeze with SitOrSquat from Charmin. The listings even come with ratings: green for clean and red for dirty. You also have the opportunity to rate and share your bathroom experience with others.

Credit Cards To Bring With You

When traveling alone, you need to carry the right cards with you. Look for perks such as emergency medical and dental benefits, travel insurance, purchase protection, and others. Here are some cards we suggest you take with you on your solo trip.

You may also want to take a look at our more comprehensive list of the best credit card bonuses here.

The Chase Sapphire Reserve® is the best overall travel credit card and the best card for travel credits. The female solo traveler will benefit from excellent travel protections and generous earning structures.

CHASE SAPPHIRE RESERVE®

The Chase Sapphire Reserve® card is offering 80,000 bonus points (worth up to $1,600 in travel per our valuations). You’ll need to spend $4,000 on purchases in the first 3 months from account opening to qualify for the bonus. These 80k points are redeemable for $1,200 toward travel through Chase Ultimate Rewards.

This is a premium travel card with a premium annual fee of $550. But, you’ll receive premium benefits such as 5X points on air travel, 10x points spent on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after earning your $300 annual travel credit, 3X points on all other travel and dining, and 1 point per dollar spent on all other purchases.

The card also features an application fee credit (up to $100) for Global Entry or TSA Pre✓®, access to 1,300+ airport lounges with Priority Pass Select, and 50% more in travel redemption through Chase Ultimate Rewards. With Pay Yourself BackSM, your points are worth 50% more for existing purchases in select, rotating categories.

The Chase Sapphire Preferred® Card is the best travel credit card for beginners and has the best welcome bonus. It offers similar travel protection and earning potential as its bigger sister, the Chase Sapphire Reserve®. Both cards reward female solo travelers with Chase Ultimate Rewards points.

CHASE SAPPHIRE PREFERRED® CARD

The Chase Sapphire Preferred® Card currently has an offer for 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

Redeeming the 60,000 bonus points through the Chase Ultimate Rewards program, which is praised by users, will get you $750 in value towards travel. The 60K bonus points are worth $750 because you get 25% more value whenever you redeem for airfare, hotels, car rentals and cruises through Chase Ultimate Rewards.

Even better, strategize with Chase Ultimate Rewards points transfer partners to potentially get even more value. Each point can be worth up to 2 cents apiece (60k points = ~$1,200). Read more on this here.

The Platinum Card® from American Express is the best travel credit card with luxury perks. While its hefty annual fee may turn off some solo travelers, you will find it makes up for it with tremendous benefits.

THE PLATINUM CARD® FROM AMERICAN EXPRESS

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The Platinum Card® from American Express has a special offer for 100,000 Membership Rewards points after you spend $6,000 in purchases within your first 6 months.

Membership Rewards® points are some of the most valuable in the market. Redeeming these points by booking travel through American Express or by redeeming for gift cards will give you a standard 1 cent per point value. The 100k bonus points are worth $1,000 going this route.

You can potentially get more value by transferring your points to Membership Rewards travel partners. Using this strategy can get you up to an average value of 2 cents per point. Get around $2,000 in value with 100,000 points this way. Read more on this here.

With this card, earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel on up to $500,000 on these purchases per calendar year.

The biggest drawback to this card is the $695 annual fee (see Rates & Fees, Terms Apply), which puts it in the premium class of credit cards. The card has a market because it offers premium travel benefits, such as 5X points for flights (up to $500,000 on these purchases) and eligible hotels, access to 40+ Centurion Loung and Studio locations worldwide, up to $200 airline fee credit annually, and an annual Walmart+ membership. These benefits are given as statement credits.

For frequent travelers, the added benefits make sense in terms of value and added luxury.

The Marriott Bonvoy Boundless® Credit Card is the best card for international travel. For the solo traveler who is a fan of the Marriott portfolio of hotels, you will gain access to the second-largest hotel chain in the world with over 7,000 properties across 131 countries and territories. The brand’s wide reach means Boundless can help fund your trip no matter where you travel.

MARRIOTT BONVOY BOUNDLESS® CREDIT CARD

The Marriott Bonvoy Boundless® Credit Card from Chase has an offer for 3 Free Nights after spending $3,000 on purchases in your first 3 months from account opening.

New to the card, you will earn 3x Bonvoy points on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. The card is also offering an Elite Night Credit towards Elite Status for every $5,000 spent.

The Marriott Bonvoy Boundless® Credit Card earns 17 points for every $1 spent at over 7,000+ participating Marriott Bonvoy hotels. You’ll receive 2 points per $1 spent on all other purchases.

You’ll get a Free Night Award (valued up to 35,000 points) every account anniversary year and automatic Silver Elite Status. Additionally, you’ll receive 15 Elite Night Credits each calendar year.

This card has no foreign transaction fees and the annual fee is $95.

READ MORE: SEE THE BEST BANK BONUSES HERE AND THE BEST INVESTING BONUSES HERE.