Charles Schwab is considered to be one of the market leaders in the field of robo-advising with their Schwab Intelligent Portfolios. Why? Because they have stuck with their promise not to charge account management fees.

Searching for a financial planner? Take a look at SmartAsset, which is free to use.

The Charles Schwab Corporation was founded in the mid-1970s and today has almost $3 trillion in assets and just over 1.5 million corporate retirement plan members. They launched their Schwab Intelligent Portfolios service in Q1, 2015.

With a low account minimum of just $5,000, it opens the door for many individuals to get started with robo-advisor services with ease (competitors like Wealthfront and Betterment also have low minimums). Signing up is straightforward and quick to do. You just need to answer 12 simple questions, the answers to which will then assess your tolerance to risk and your overall confidence in making decisions of a financial nature. They prefer to use the term ‘”automated investing” as opposed to robo-advisor, but it is the same thing. See the list of the current best Robo-Advisors here.

The standout feature of Schwab Intelligent Portfolios is their internal ETFs which they select from their own services. This is different from other robo-advisor services like Wealthfront and Betterment, as they are brokers. Whereas, with Intelligent Portfolios, Schwab is self-clearing and uses its own ETFs. This does give them an advantage because they are not just a platform, such as is the case with Betterment and Wealthfront.

Compare top Robo-Advisors with SuperMoney

Schwab Intelligent Portfolios $1000 Sign-Up Bonus

Just like how you can earn $1000 sign-up bonus for opening a new Checking Account, their Intelligent Portfolios product also is eligible for the $1000 bonus opportunity.

Just use the offer page and click on the “Open an Account” button and you’ll see Intelligent Portfolios as an option to open.

- Open an eligible account here to get your Bonus Award.

- Make a qualifying net deposit of cash or securities within 45 days.

- They’ll deposit the Bonus Award into your account about a week after the 45-day qualification period.

- $25,000–$49,999 deposit = $100 bonus

- $50,000–$99,999 = $300 bonus

- $100,000-$499,999 = $500 bonus

- $500,000+ = $1,000 bonus

Terms

- Offer valid for referred individuals who do not currently have a Charles Schwab & Co., Inc. (“Schwab”) account (other than a Stock Plan Services account) and who open and make a qualifying net deposit into an eligible retail brokerage account within 45 days of enrolling in the offer.

- Net deposits are assets deposited into the enrolled account minus assets withdrawn from the account and transferred out of Schwab.

- Only outside assets new to Schwab qualify; assets transferred from affiliates other than Schwab Retirement Plan Services are excluded.

- Net deposits will be calculated as of the 45th day after enrollment, and the bonus award will be credited to the enrolled account within approximately one week.

- For taxable accounts, you must maintain the net deposit amount (less any market losses) at Schwab for at least one year or Schwab may charge back the bonus award.

- Schwab reserves the right to change the offer terms or terminate the offer at any time without notice.

- This offer is limited to one per account, with no more than one account enrolled per client.

- It does not apply to accounts managed by independent investment advisors, the Schwab Global Account™, ERISA-covered retirement plans, certain tax-qualified retirement plans and accounts, or education savings accounts.

- The bonus award, when combined with the value received from all other offers in the last 12 months, may not exceed $5,000 per household, as defined in the Charles Schwab Pricing Guide for Individual Investors.

- This offer is not transferable, saleable, or valid in conjunction with other offers and is available to U.S. residents only.

- Employees, contractors, or persons similarly associated with Schwab or a Schwab affiliate; their spouses; and employees of any securities regulatory organization or exchange are not eligible.

- Other restrictions may apply.

- Consult with your tax advisor about the appropriate tax treatment for this offer and any tax implications associated with receipt before enrolling.

- Any related taxes are your responsibility.

- For taxable accounts, the bonus award will be reported on your Form 1099-INT.

- IRS guidance may impact your ability to make more than one IRA-to-IRA rollover in a one-year period.

Here’s my referral link (code REFER4U498PXV) if you need one to sign up for the offer. I receive no compensation or reward for the referral. Once you have an active account, you can find your referral link after logging in.

Who Is Schwab Suitable For?

- Those who are new to investing

- Anyone who wants to invest with the support of a well-established business

- IRA Investors

- If you do not want to pay out for Financial Advisor fees, accounts service fees or commissions

- Those who don’t have a lot to invest

- Those who want to invest and trade with a large number of ETFs and asset classes

The overriding plus factor for Schwab Intelligent Portfolios is the fact that it is part of the Charles Schwab business. The ability you get to customize your portfolio, the large range of investments you can select from, the low account minimum, and the free account management makes it ideal for many.

However, the high cash allocation and tax-loss harvesting minimum bracket of $50,000 does not make it suitable for all.

How Do You Open An Account With Intelligent Portfolios?

You will be taken through a 12 point questionnaire which will ascertain your risk profile, time frame and objectives. Each answer you give to the questions asked will determine your stock to bond ratio, producing an overall asset allocation at the end.

In order to open an account with Schwab Intelligent Portfolios, you will need to have a minimum of $5,000 to invest. They support both retirement and taxable accounts. If you have more than $50,000 in taxable investments, you will be granted access to their tax-loss harvesting services.

There are a total of 37 portfolios that Schwab Intelligent Portfolios will select from, with 54 ETFs. This is a very comprehensive selection compared to most competitors.

Something that is important to note is that your investments are not insured under FDIC. However, Charles Schwab does have SIPC insurance.

Pros And Cons Of Schwab Intelligent Portfolios

Overall Cost of the Service

There are no account fees, commissions, or advisory fees to pay for with this service. The only cost that clients will need to pay for is the net expense ratio which is determined by the ETF holdings within the portfolio. These fees are typical and considered to be commonplace for robo-advisor services. These fees range from 0.08%-0.24%.

As of 2017, Schwab Intelligent Portfolios is the only robo-advisor service not to charge their clients an annual fee for management. Overall, they appear to be the lowest cost robo-advisor service on the market right now with respect to their advertised fees.

Customizable Portfolio

As with all robo-advisor services, you will get a tailored portfolio that fits your profile. However, you do not have to accept the suggestions made, and you can easily customize their pre-selected choices by selecting up to three ETFs to take out and replace with other investments which you might prefer.

Scope of Investment

Schwab Intelligent Portfolios has a solid array of more than 50 ETFs over 30 alternative classes. As you would expect from a company that has been in business for as long as they have, they have a great reach, some of the options are emerging markets, stocks, real estate investment trusts, bonds, and commodities.

Looking at two other major players; Betterment has 12 different asset classes, and Wealthfront has just 11. This is a real plus for Schwab Intelligent Portfolios customers.

Tracking your Objectives

If you are saving for something that requires a significant amount of capital, you need to be patient and disciplined. However, being able to track your performance against your objectives clearly is a great motivational tool. The goal tracker from Schwab Intelligent Portfolios gives you a daily overview of how you are tracking against any goals that you may have set.

This nifty tool will report on a number of different factors. It will show you if you have a more than 50% chance of attaining your goals. It will flag them up as being at risk if you fall between a 25%-50% chance of attaining your objectives, and it will show you as off-target if you fall under the 25% chance mark.

It doesn’t just stop there, the goal tracker will make recommendations for adjustments which will enhance the likelihood of you attaining your objectives. These could be by making a one-off contribution or by altering your monthly payments. It might also suggest that you change your risk profile.

It is also a great tool for those who are no longer building wealth and who might soon be looking to take an income from their investments.

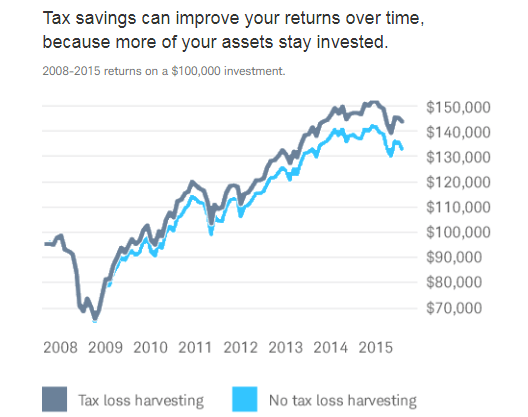

Tax Loss Harvesting

Although Schwab Intelligent Portfolios does indeed offer this service, I don’t like the fact that is in only available on balances of more than $50,000. After all, this element of the service is where other robo-advisors really do offer something useful to Investors. With all the complexities that can arise from selling, if it a function that is much-loved by those who use robo-advisor services. If you don’t have the minimum they require, it can be a real turn-off and is probably why Schwab Intelligent Portfolios will lose some business to their competition.

Cash Positions in Portfolios

This is perhaps one of the major flaws in the services offered by Schwab Intelligent Portfolios. The fact that the underlying principals of their strategy are to place a large percentage of that pot in cash is a little unnerving for some. It is between 6%-29.4% of their total portfolio holdings. Essentially, the cash is placed into a deposit account which will accumulate interest based on the average money market rates nationally. For some Investors, it means that their asset allocations are a little too conservative. The main challenges this approach presents are below:

- Schwab Intelligent Portfolios will make money from your cash. These funds are held within an FDIC insured bank account belonging to Charles Schwab. This cash is then used to make money based on the spread. This is the difference between the amount of interest you will earn and what they will earn themselves by investing it elsewhere or loaning it out.

- If cash sits in the same place, without being put out on the market, it is called a “cash drag”. The overall portfolio returns can be brought down by this low return of money that sits stagnant in the cash pot.

This approach might work for some, but for those who are serious about investing with an element of risk Vs. reward, it is a little too dull for their liking.

Customer Service

Although there are many positive aspects to the customer service team at Schwab Intelligent Portfolios, there are some majors flaws with it as well. You have the choice to get in touch with the team via the phone or through a live chat function. The biggest complaint is typically related to their live chat function. In some cases, there was no response received whatsoever. At other times the service was considered to be a little patchy with frequent error messages, and on other occasions, no connection to an advisor was able to be made. This would be a little frustrating if you were a customer and had limited time available in order to resolve your queries.

Email is a preferred method for most who are limited with their time and need to send a question there and then. Not only was it very difficult to locate an email address for the business, when one was found, it also took several days just to hear back, if at all. This is something I feel they really need to get to grips with, quickly. Having a robust live chat and email support option is crucial.

Summary Of Schwab Intelligent Portfolios

Having an independent site for Schwab Intelligent Portfolios is a good thing in my opinion. The site looks good, and it is easy to find your way around. Knowing that you are investing in a business that is as well-established as Charles Schwab is, makes for a comforting investment proposition. Their wide range of portfolio options and the added benefit of the flexibility offered by this robo-advisor service is also reassuring.

The low cost of using the service is a key feature, along with the low account minimum requirements.

If you are looking for help with tax harvesting, I feel their minimum of $50,000 is a little too high, and when compared with the likes of Betterment and Wealthfront, this is definitely an area where they fall short. Another real sticking point for us is the customer service element too. You need to be able to reach someone by email or live chat in a time-efficient manner, and this is not reported upon well by those who have tried to use these services.

However, they have created a good investment management service that is both low-cost and innovative, allowing investors of all levels to confidently invest in the market with a determined and informed approach.

It is also ideal if you are an existing customer of Charles Schwab.

There’s one other important point to bring up. At first glance, Schwab Intelligent Portfolios would appear to be the lowest cost of all robo-advisors, but it is not. Once you take into account the ETF fees along with any returns lost from the 6%-24% cash allocation, their fees are actually inline or worse than other robo-advisor services. When something is stated to be free, it is always worth a further investigation to ascertain the true validity of that statement.

Despite being one of the first players in the robo-advisor space, other options have come out which are more cost-effective and also offer a more reliable customer support structure for their customers.

*My Investments Disclosure

I’m constantly tweaking my investment strategies as I gain more insight and as investment options evolve. Below is my current lineup.

- Vanguard funds. As the great Warren Buffett recommends, I invest a good portion into an S&P 500 index fund directly with Vanguard. Most of my investments here are in the VOO Vanguard S&P 500 ETF. With an Expense Ratio of just 0.04%, this is a great way to diversify and save a great deal on fees. I’ve also decided to diversify further with the total stock market, investing in the VTI ETF with Vanguard.

- Wealthfront. If you’re a good number of years before reaching retirement, many finance experts suggest going with a robo-advisor. With so many good reputable robo-advisors on the market, I decided on Wealthfront based on their track record, client reviews, and because I’ve been able to waive all management fees through their referral program.

- Fundrise. I wanted to have an alternative to stocks and bonds, and decided to dip my toes in the private real estate arena with Fundrise. I’m not all-in on this strategy just yet, and only have a small account open.

- Bitcoin and cryptocurrency. I have minimal investments in Bitcoin and the cryptocurrency space. Be sure to click the link to get the latest offers for free Bicoin and more.

- Posts not found

READ MORE: SEE THE BEST BANK BONUSES HERE AND THE BEST INVESTING BONUSES HERE.